do you pay taxes when you sell a car in illinois

In addition to completing the application form you will also need to pay the. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

What New Car Fees Should You Pay Edmunds

Here are typical fees in Illinois.

. Its only 15 if the. Who pays sales tax when selling a car privately in Illinois. If youre buying a car for 40000 and your trade in is worth 20000 you only have to pay tax on the difference which in this case is 20000.

Use the Illinois Tax Rate Finderto find. - Answered by a verified Tax Professional. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

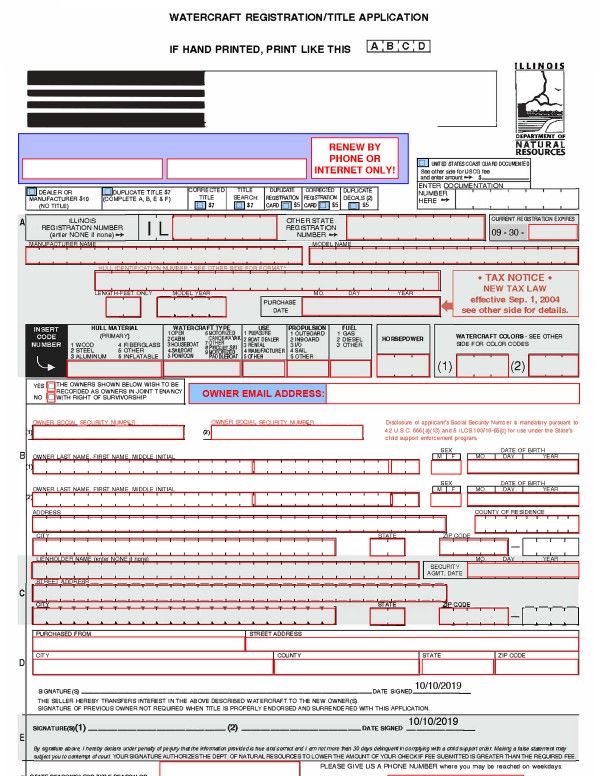

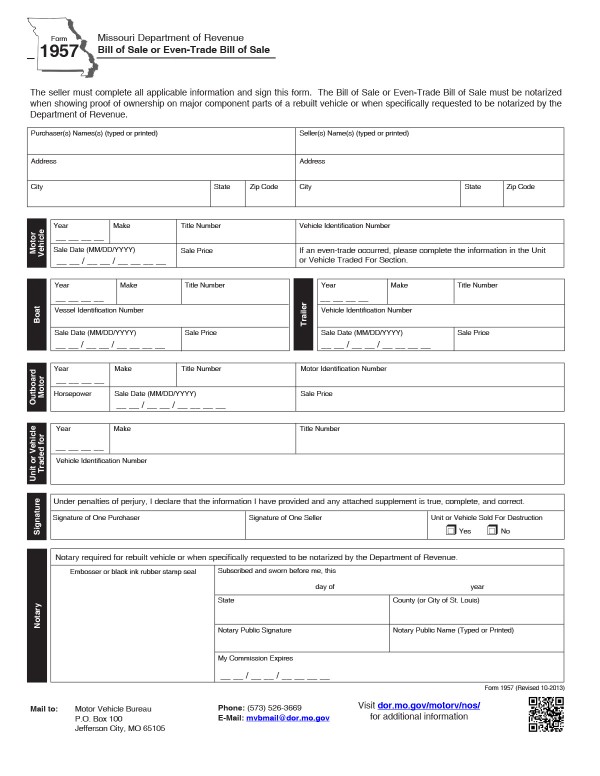

The bill of sale is very important because it will determine whether you need to pay taxes or not and it will also decide on the amount of taxes you have to pay. The appropriate tax form. DMV or State Fees.

For example you are giving a car that is worth 20000 in a given year then you have to file a gift tax return on the extra 5000 for that tax year. Payment for fees and taxes. You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980.

Cost of Buying a. What tax do I pay. Illinois sales tax 625 is only paid at the time of purchase so if you gift a car worth 20000.

That would translate into 2895 million going to federal coffers in all leaving you with a cool 4929 million. State taxes could also be due depending on where the ticket was. The state sales tax on a car purchase in Illinois is 625.

Illinois residents who buy vehicles in states where the sales tax is lower must pay the difference to the Illinois Department of Revenue. For vehicles worth less than. It ends with 25 for vehicles at least 11 years old.

What is the Sales Tax on a Car in Illinois. See Paperwork for Illinois Car Buyers above for tax form options. A bill of sale IF the required vehicle information is not on the title.

If I sell my car do I. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. The average local tax rate in Illinois is 1903 which brings the.

And does the buyer have to pay Tax. For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

For a Missouri sale it appears that the. The tax only applies to the. Selling a car for more than you have invested in it is considered a capital gain.

Thus you have to pay. I am selling a used car for 9900 in Illinois. It starts at 390 for a one-year old vehicle.

When you sell a car for more than it is worth you do have to pay taxes. If youre not going to sell the vehicle at market price then gifting is the way to go. We use cookies to give you the.

As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois. However you wont need to pay the tax. Vehicle sales tax for vehicles sold by a dealer Usually 625 but can vary by location.

Heres how the law works. What is the sales tax on a car purchased in Illinois. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in.

What S The Car Sales Tax In Each State Find The Best Car Price

Free Illinois Bill Of Sale Form Pdf Word Legaltemplates

Illinois Bill Of Sale Forms And Registration Requirements

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Illinois Trade In Tax Coming Chicago Il Marino Cdjr

Missouri Bill Of Sale Form Templates For Autos Boats And More

How Many Cars You Can Sell Without A Dealer S License Canadian Gearhead

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Should I Buy A Car From Carmax Rategenius

Tax Issues In Selling A Business Vehicle

Why You Might Pay More To Buy A Car In Illinois A Trade In Tax Credit Cap

How To Charge Sales Tax In The Us A Simple Guide For 2022

New Illinois Law Removes Tax Credit Cap When You Trade In Car While Buying New Vehicle

States With No Sales Tax On Cars